Check out some of these high-frequency trading strategies for digital asset hedge funds below:

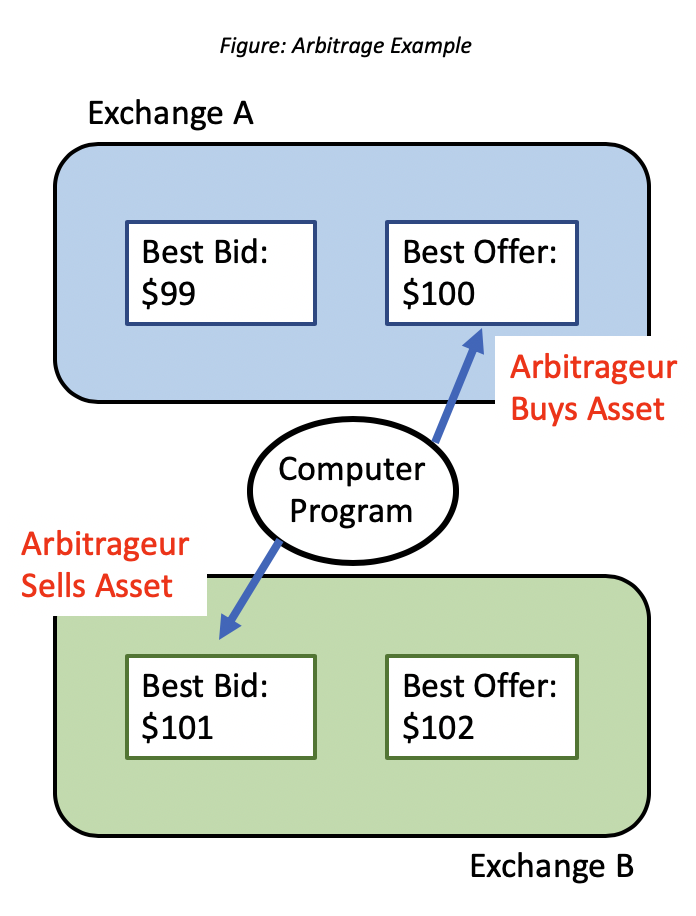

Arbitrage: This is the most fundamental high-frequency trading strategy where the trader aims to capture a difference between two markets, buying an asset at a low price and simultaneously selling at a higher price. Typically there is a computer program (or bot) that monitors the prices of various markets across two different exchanges. When the bot detects a profit opportunity that fits the arbitrageur’s parameters, the program will send orders to both exchanges and proceed with the transaction.

In the above example, there exists an arbitrage opportunity between Exchange A and Exchange B. A market taker can buy the best offer at $100 on Exchange A and simultaneously sell the same amount they purchased on Exchange B for $101, locking in a $1 profit per unit. Bots can perform this action hundreds if not thousands of times per day and realize a hefty profit.

However, there are some parameters to consider to make sure this strategy is practical in real life. Requirements: Need to have inventory on both exchanges you’re looking to arbitrage.

In the above example, there exists an arbitrage opportunity between Exchange A and Exchange B. A market taker can buy the best offer at $100 on Exchange A and simultaneously sell the same amount they purchased on Exchange B for $101, locking in a $1 profit per unit. Bots can perform this action hundreds if not thousands of times per day and realize a hefty profit.

In this instance, the bot acts typically as a market taker, which is important to note since most exchanges have different pricing tiers for market makers and market takers.

Triangular Arbitrage:

Cross-Exchange Market Making:

https://docs.hummingbot.io/strategies/cross-exchange-market-making/

Pure Market Making:

https://docs.hummingbot.io/strategies/pure-market-making/

For more information about high-frequency trading strategies and other ways to manage digital hedge funds, contact Tech Meets Trader today.