Components of a Digital Asset Trading Venue

Digital asset trading venues can take many different forms. People turning to an exchange, for instance, get different kinds of trading experiences than those turning to brokerages. While these differences matter, it’s also important to note that digital asset trading venues share many of the same “under-the-hood” components. Just as a sports car and a minivan have a similar engine schematic, virtually all exchanges and brokerages rely on an interdependent family of key components. Let’s take a closer look:

KYC/AML Procedures

Know Your Customer and Anti-Money Laundering procedures are required by different laws in financial institutions across the world. Just like a bank with a new customer, KYC-compliant exchanges make users prove their identities before they open an account or can access trading capabilities. Some exchanges provide tiered KYC requirements, with minimal ID confirmation unlocking basic crypto trading and more comprehensive documents (such as address verification) required for access to fiat services. Anti-money laundering procedures surveil trading, deposit, and withdrawal activity. During this process, some users may be classified as “high risk” and even have their transactions delayed or accounts suspended if suspicious activity is detected. Exchanges may perform these services in-house or outsource them to professional firms such as Chainalysis, Comply Advantage, and Shufti Pro.

User Service

User services store and provide other components with access to comprehensive information on each account in the exchange. That information includes contact information, identity information, two-factor authentication settings, KYC status, password and login credentials, and any other unique information tied to an individual user.

Accounting Service

An accounting service is a general ledger of all transactions that have occurred on the exchange. The ledger uses double-entry accounting, which means it records four new entries for each transaction–one to record assets gained by the first trader, one to record assets lost by that trader, and two more to record assets lost and gained on the transaction’s other side, creating a comprehensive record of all transaction activity. This service typically lives within the Order Management System but can be segregated based on the architecture of the exchange’s microservices.

Wallet Service

Wallet services communicate with custodial providers to confirm that traders are solvent and have access to the funds needed to deposit or withdraw their assets. Exchanges differ in how they approach custody. Some make users store their funds in a “hot wallet” owned by the exchange, some allow cold storage solutions like hard drives that wallet services can interface with, and some use solutions created by specialized trust companies. The most common custodian architecture uses both hot and cold wallets. Hot wallets store what’s needed for the average day-to-day inflow and outflow, while cold storage will house the majority of assets. Bitgo, a leading custodian in the digital asset space, extends $100,000,000 worth of insurance to customers who use Bitgo’s cold storage solution and split their private keys amongst three different parties (e.g., the customer, Bitgo, and a trust company) for hot wallet use. Curv, a newer and less expensive alternative to Bitgo, is also gaining popularity. Curv extends $50,000,000 worth of insurance to protect hot wallet infrastructure, and since they use elliptic curve cryptography their users aren’t required to give trust companies any portion of their wallets’ private keys. Trust companies and the custodians who work with them communicate with exchanges via API’s that store whitelisted IP’s and multi-step processes for authenticating transactions.

Asset Manager

Asset managers acquire, hold, and disburse assets in accordance with instructions from the venue’s matching engine and order management system. They communicate with wallet services and accounting services as well to ensure that asset movement through the exchange matches changes in each trader’s accounting ledger and the assets in their custody. While moving assets, asset managers keep track of individual inventory identities and how the venue handles them, differentiating, for example, between token A sold in increments as small as .01 and token B sold in increments as small as .001.

Order Management System

The Order Management System (OMS) manages access to the trading venue by allocating permissions to different accounts and users, letting them perform important exchange actions such as executing trades. The OMS helps individual users perform transactions and control order parameters such as setting a maximum buy price to communicate to the order book. A large number of order-related activities, such as deposits or notifications, may be handled by a multi-module or single-piece OMS.

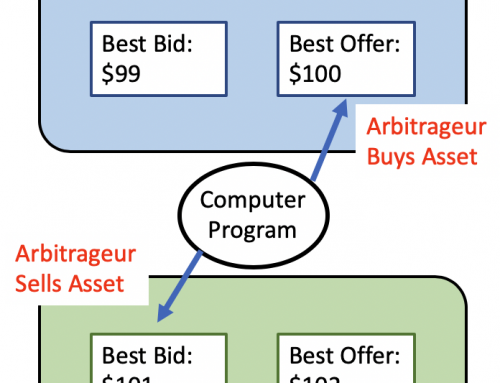

Matching Engine

Any potential transaction involves a buyer and a seller, and the transaction only takes place if both buyers and sellers agree on the price and volume of assets flowing both ways. An exchange is essentially many long lists of bids to buy and offers to sell that only turn into transactions when buyers and sellers find someone who matches the bids and offers. Those long lists are called an exchange’s order book, and matching engines hunt through web-hosted order books to find matching sellers and buyers. When they find a match, they communicate with other components of the exchange, such as the asset manager and the accounting service, to settle the transaction.

Reporting Service

The reporting service gathers and exports data logs covering trades, account balances, and the general exchange ledger. These reports are invaluable for important administrative tasks such as building management dashboards and ongoing compliance monitoring. Exchanges may use reports to track overall deposit and withdrawal activity for each asset, trading volume per asset, or each asset’s spreads. The reporting service can also be used for investigative purposes to carry out AML procedures, to help trading operational teams identify one-sided trade events, or for any marketing, design, or compliance initiative that requires better understanding of user behavior given different market conditions. Oftentimes, exchanges will consolidate these aggregated data points and pass along informational reports to high-value customers to entice them to trade more often. The information gathered by reporting services can provide key insights as to where traders on the venue see the market moving, how customers are positioning themselves, and potential risk exposure for market makers.

External Gateway

The components above are essential to helping the internal “engine” of the exchange hum along, but a complete trading venue also needs an outlet for its human users and other parties to interact with the exchange. The external gateway is this outlet. It typically takes the form of a FIX (Financial Information Exchange, a common communication protocol in the financial world) API coupled with a WebSocket communication protocol. The API provides an interface to access the exchange’s different components, letting users initiate these components’ interlocking services. Communication protocols facilitate secure, real time sharing of information between users and the exchange architecture. Some of those users are themselves microservices, such as market makers who help the exchange provide liquidity. Because the external gateway is an outlet to the outside world, security is of especially high concern for this component, and different kinds of access to the outlet may be segmented from other users for security reasons.

Administrator UI

Exchanges need human maintenance, and people with administrator rights can provide that maintenance via the administrator user interface. This interface provides a dashboard where administrators can carry out important tasks, such as assisting customers or modifying faulty transactions. The Admin UI is where team members can also add, remove, and edit trading products and markets. Within this interface users are segmented based on permissions, meaning, for example, that customer service teams can go about their duties assisting customers without receiving the administrative rights needed to edit available API calls or halt trading across various markets.

Customer UI

It’s the last component listed here, but the customer user interface is the only component the vast majority of venue customers actually see. After confirming their user credentials, a customer UI delivered via web page, phone app, or however else the exchange makes itself available provides traders with tools to initiate transactions, change bot parameters, monitor different market indicators, and provide many other services in addition to initiating basic transactions. The customer UI is an important element of exchange design and marketing. A beginner-friendly, simple interface can help the exchange attract newer crypto users, while more sophisticated widgets and tools will attract more advanced users. A frustrating UI, on the other hand, can drive customers away.

Conclusion:

Though you can find all of these components working together in virtually any digital asset trading venue, that doesn’t mean all exchanges and brokerages are the same. On the contrary, these elements create a foundation upon which exchange developers can innovate. Different fee structures, trading pairs, custodial requirements, and leverage options all help trading venues offer their own competitive edge and spur further innovation in the digital asset field. To learn more about using digital trading venues to grow your fund or even build your own competitive venue, contact Warren Lorenz at TechMeetsTrader.